- Quickbooks small business track mileage how to#

- Quickbooks small business track mileage full#

- Quickbooks small business track mileage plus#

- Quickbooks small business track mileage free#

Quickbooks small business track mileage how to#

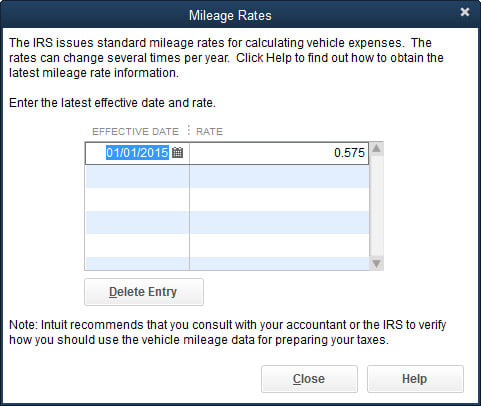

Read More - What are the System Requirements for QuickBooks Desktop and Enterprise? How to Set up Automatic QuickBooks Mileage Tracker?

Quickbooks small business track mileage plus#

Quickbooks small business track mileage free#

The app is free for present users and it is built in QBs.

Quickbooks small business track mileage full#

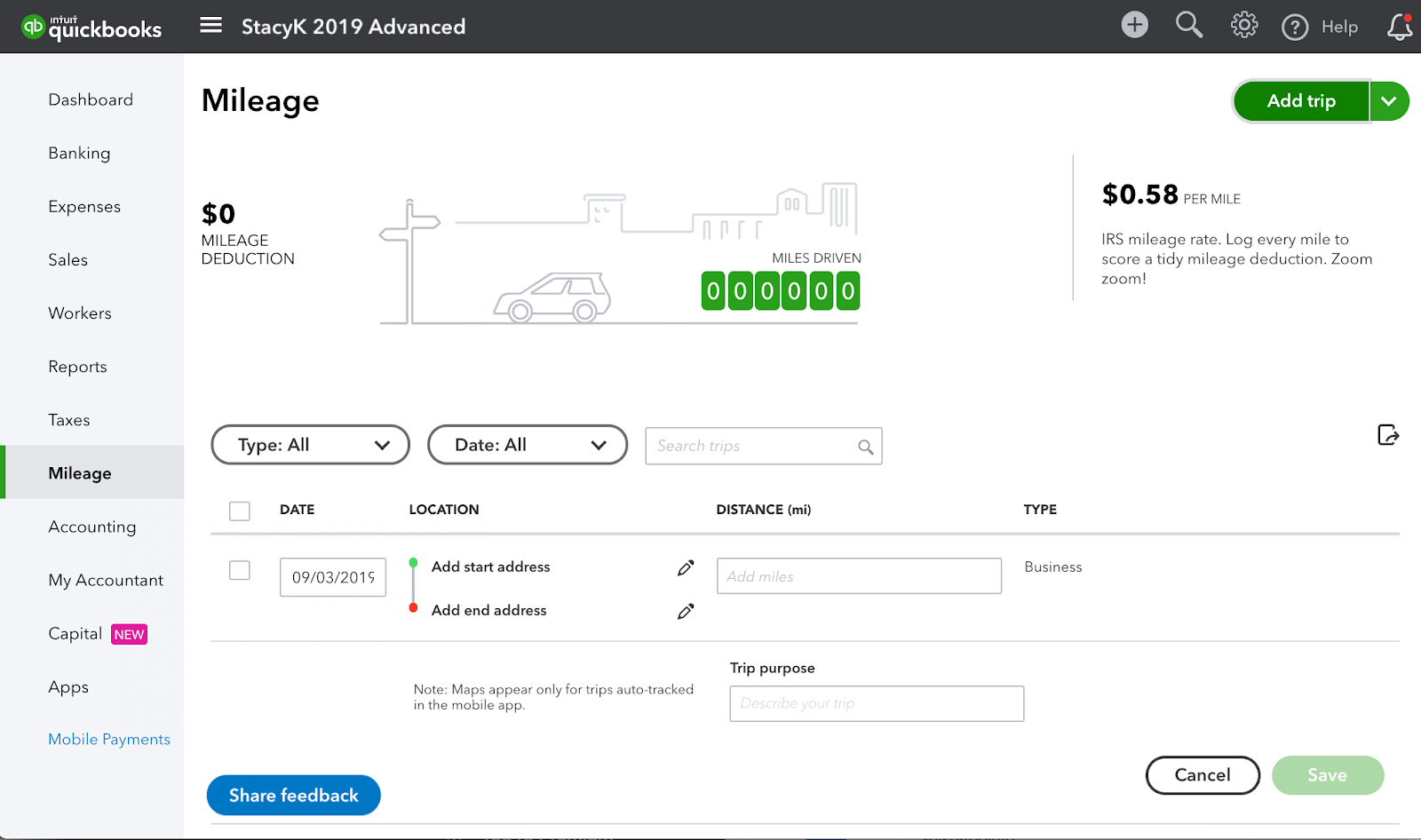

Because before you use it you should be aware of it with full information. Let’s look at the pros and cons of QuickBooks mileage tracker. Read More - How to Create Proforma Invoice in QuickBooks? Pros and Cons of QuickBooks Online Mileage Tracker Automatic Tracking: QuickBooks online is the best accounting app that tracks the mileage automatically whenever you take a drive.The expense monitoring features of QBs online include mileage tracking. Income & Expense Tracking: You may easily connect your bank & credit card account to track your income and expenses.It allows you to add trips that are not mentioned in your record and can ask for repayment from clients by adding them to your expenses. Trip Classification: You can classify your trip as a personal or business one.Listed below are some of the features of QuickBooks mileage tracking:. With the tracking mileage in QuickBooks online, you can make sure that it has been recorded in actual time and you will get it back whenever you want it.

You can claim reimbursement for business expenses or deduct them from your taxes for each mile that you took to meet clients or run any transactions. QuickBooks online mileage tracking allows you to keep track of miles/KM needed at the time of tax reduction or compensation. But why is it so important? Let’s take a closer look. Mileage tracking can be a huge time saver for businesses of all sizes, and it can help you keep track of important business expenses. One such tool is the QuickBooks mileage tracker. Thousands of businesses use QuickBooks each year, but many of them don’t realize all the different features and tools that are available to them. You already have so much on-the-go, let QuickBooks take some things off your hands.Do you ever feel like you’re not getting the most out of your QuickBooks software? If so, you’re not alone. You can also build your employee schedules by jobs or shifts, and you can easily edit, publish, and share the schedule with your workers in real-time. All your employees have to do is submit their hours through the QuickBooks mobile app, and their timesheets are updated in an instant.

Don’t live in the stone age, let QuickBooks bring you into the 21st Century with QuickBooks Time. Not only do you have to ensure that your employees are clocking in at the correct times, but that all their holiday or paid time off is being recorded accurately. Keeping track of your employees’ timecards is a huge task. All your business-related mileage will be stored securely in your QuickBooks account.

All you have to do is turn on the app, and drive. QuickBooks has made it easy with their mileage tracker that is available on the QuickBooks mobile app. Tracking your mileage can become cumbersome and most of the time it’s easy to forget to track them. Like many small business owners, being on the go is a part of the business model. Stored conveniently and securely in the cloud, tracking your expenses has never been easier with the QuickBooks mobile app. No more storing receipts in a shoebox in the back, simply scan the receipt with your phone’s camera and the built-in receipt scanner, will keep record of your business expenses.

Luckily QuickBooks will help by keeping your expenses, mileage, and time tracking, all in one place. As a small business owner there is a lot to juggle at one time.

0 kommentar(er)

0 kommentar(er)